In a major move within the crypto market, one of the top whales from the original TST list, known as Dingaling (@dingalingts), has reportedly closed their trade positions, netting an estimated $2.24 million in profits.

On-chain analysis indicates that Dingaling initially acquired 20.02 million TST tokens at an average price of $0.0006268.

The timing of this strategic liquidation coincided with significant market developments surrounding the TST token, particularly after Binance announced its listing on the exchange’s spot market.

The provided Dingaling with an opportune moment to capitalize on their holdings, taking advantage of the token’s price surge following the listing.

Whale Withdraws Tokens from PancakeSwap, Sells Millions for Profits

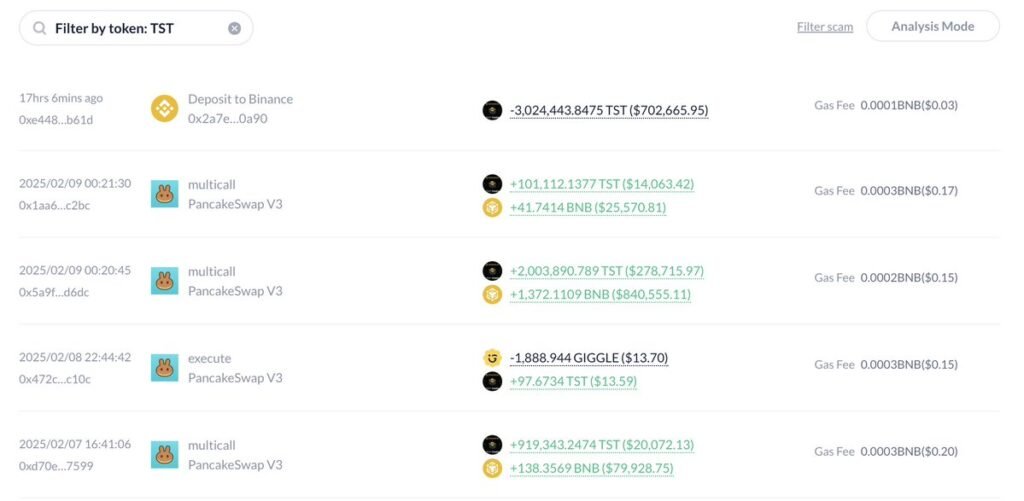

Dingaling’s investment strategy involved injecting a significant portion of their TST holdings into PancakeSwap to provide liquidity.

Over the past two days, the whale withdrew 3.02 million TST tokens and 1,552.2 BNB from PancakeSwap, which signals a reduction in their liquidity position.

During this period, approximately 16.99 million TST tokens were sold, with an average selling price of $0.05565 per token.

The move allowed Dingaling to secure substantial returns on their initial investment. By withdrawing the liquidity and selling at this price point.

The whale demonstrated a sophisticated understanding of market dynamics and capitalized on the liquidity available through decentralized platforms.

Also Read: Crypto Trader Turns $5K into $12M Via $CAR Memecoin Trade In Three Hours, Secures 2,450x Profits

Binance Listing Drives TST’s Price Surge, Allowing for Higher Profits

The TST token’s value received a significant boost following the announcement that it would be listed on Binance’s spot market.

The development proved to be a key catalyst for Dingaling’s final move, which involved recharging the remaining 3.02 million TST tokens back into Binance at an impressive price of $0.4331 per token.

The price surge, driven by the listing on one of the world’s largest exchanges, enabled Dingaling to secure a higher price than their initial entry point, allowing for increased profits.

The listing of lesser-known tokens like TST on major exchanges such as Binance often results in sharp price increases, as it increases the token’s accessibility and credibility in the eyes of retail and institutional investors.

Estimated Profits and Broader Market Impact

Based on the transactions executed by Dingaling, their estimated profits from the TST trade amount to around $2.24 million.

However, the final profit could vary depending on the precise selling price on centralized exchanges like Binance.

While Dingaling’s calculated moves showcase a keen market awareness, they also reflect broader trends in the cryptocurrency market.

Whales and institutional investors play a crucial role in influencing token prices, especially through liquidity provision, strategic market listings, and timing their buy-sell positions.

The success of Dingaling’s trade raises questions about the influence that large players have on the market and whether other investors will adopt similar strategies to take advantage of market events and listings.

Recent Investor Moves Across the Market

Dingaling’s trade gains are part of a broader trend of high-profile crypto investors making waves in the market.

For instance, a major PEPE whale liquidated 20.12 billion $PEPE tokens amid an extended market downturn, incurring a $1.2 million loss as the price of PEPE dropped by 27.72%.

Similarly, a Venice Token ($VVV) investor suffered a 39% loss on a $3.7 million position after the token’s value plummeted 38%.

On a more positive note, a crypto whale made $3 million in profits from a 12 million Ethena ($ENA) token trade, capitalizing on the token’s price volatility.

These movements highlight the dynamic nature of the cryptocurrency market, where investors can see both significant losses and gains depending on market conditions and timing.

Also Read: Crypto Trader Makes $589K Profit in Less Than Two Hours by Shorting $BERA After Its Listing