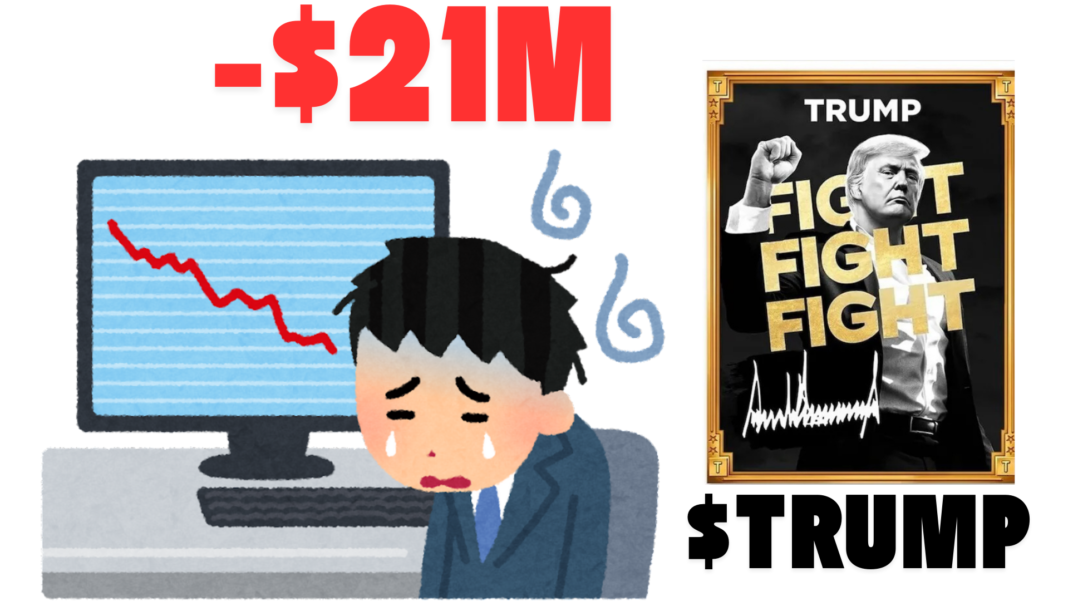

A massive $33.9 million trade involving the $TRUMP token has resulted in a staggering $21 million loss for a crypto whale, overshadowing earlier profits.

Initially, the whale capitalized on a price increase, purchasing 860,895 $TRUMP tokens for $12 million at $13.94 each.

The trade turned profitable, as the whale sold the tokens at $27.67 each, netting $23.8 million in $USDC and generating a profit of $11.8 million.

However, the situation quickly soured when the whale made a risky follow-up trade, purchasing 766,083 $TRUMP at $44.25 each, a move that ultimately led to significant losses.

The price of $TRUMP failed to maintain its upward momentum, resulting in a $21 million downturn that wiped out previous gains and a substantial portion of the initial capital.

Risky $TRUMP Trade Turns From Profits to Losses

The whale’s transition from profits to a heavy loss began on January 18, when they sold their initial $TRUMP holdings and made a considerable gain of $11.8 million.

However, buoyed by the initial success, the whale took a more aggressive stance, purchasing $TRUMP tokens at a higher price, spending $33.9 million on 766,083 tokens.

Although initially promising, it quickly proved disastrous as $TRUMP’s price could not sustain its bullish trajectory.

The whale’s significant capital outlay soon turned into a sharp decline, ultimately costing them not just their previous gains, but also a large chunk of the initial investment.

Volatility and Risk in Crypto Markets: A Cautionary Tale

This incident serves as a stark reminder of the volatile nature of cryptocurrency markets, where fortunes can be made and lost in the blink of an eye.

The crypto whale’s earlier success illustrates how astute market timing can yield significant profits. However, the subsequent loss reveals the risks involved when trading in highly speculative assets, where prices can fluctuate dramatically.

Despite the whale’s early profit of $11.8 million, the follow-up trade and the lack of price sustainability led to a harsh lesson in the unpredictability of the market.

In a space characterized by such volatility, traders must be prepared for the potential for substantial losses, even after initial success.

Related On-Chain Trader Losses and Whale Dominance

This crypto whale’s loss is not an isolated incident. A well-known trader, “Traderpow,” initially made a $22.7 million profit from $TRUMP trades but soon faced an $8.48 million loss after reinvesting $16.7 million at higher prices.

The $TRUMP token’s price plummeted by over 57% in just a week, further affecting market sentiment and leaving many traders with unrealized losses.

Moreover, a report revealed that whales control 94% of the $TRUMP and $MELANIA tokens, with just 40 wallets holding the majority of the supply.

The dominance by whales adds another layer of risk, as large movements by these whales can significantly impact token prices, adding instability to the market and posing challenges for smaller investors trying to navigate the volatility of these speculative assets.