A significant market event has unfolded in the PEPE token ecosystem with a major whale investor executing a substantial liquidation of 552.92 billion PEPE tokens, converting them to $6.92 million in USDC.

This strategic exit as reported by Onchain Lens on X earlier today, occurred after approximately 1.2 years of accumulation, resulted in a profitable conclusion to the investor’s position.

The whale’s initial investment strategy involved accumulating 1.48 trillion PEPE tokens with a total investment of $7.43 million, ultimately securing a remarkable profit of $3.42 million through careful position management.

The transaction represents one of several major movements in the PEPE market, joining other notable trades including a recent $8.5 million liquidation of 427 billion PEPE tokens by another investor who secured a $2 million profit.

Current Market Performance and Price Impact

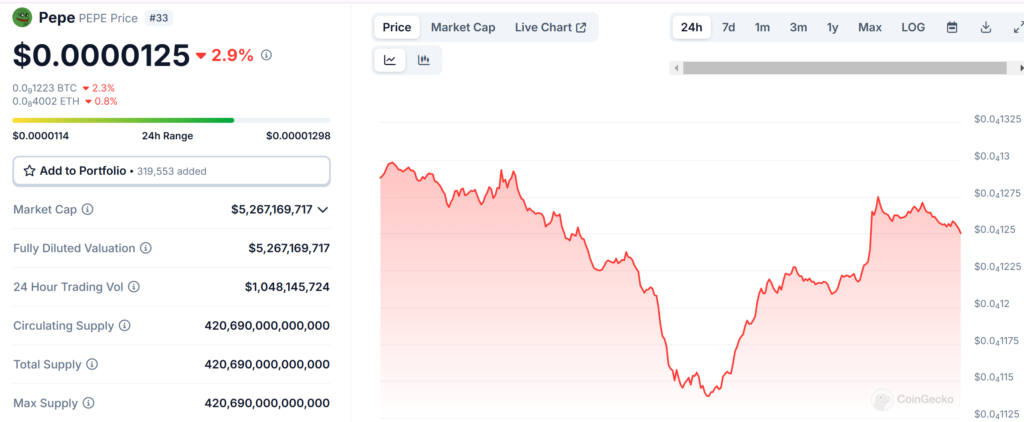

The immediate market reaction to these large-scale movements has been notable, with PEPE currently trading at $0.00001251, representing a 2.96% decline in 24-hour performance and a more substantial 20.64% drop over the past week.

Despite these downward pressures, the token maintains a significant market presence with a total capitalization of $5.26 billion.

Trading volume remains robust at $1.04 billion over the past 24 hours, indicating sustained market interest despite price volatility.

This high trading volume suggests active market participation from both buyers and sellers, potentially creating opportunities for price stabilization despite the recent selling pressure.

Pattern of Profitable Trading Activities

The cryptocurrency market has witnessed a series of profitable PEPE trading activities in recent months.

A particularly noteworthy case involves a trader who accumulated $5.97 million in total profits over six months through strategic trading of 588.2 billion PEPE tokens.

However, the market’s volatility is evident in contrasting cases, such as a trader who, despite previously securing $1.8 million in profits across nine trading cycles, now faces a $603,000 loss on a new $4.36 million position.

These varying outcomes highlight the high-risk, high-reward nature of PEPE token trading and the importance of timing in securing profitable exits.

PEPE Market Trends and Future Prospects

The series of large-scale liquidations by major holders presents both challenges and opportunities for the PEPE token ecosystem.

While significant selling pressure from whales could potentially trigger further price declines, the maintained high trading volume suggests resilient market interest.

The token’s market dynamics are currently characterized by a complex interplay between large holder movements and broader market sentiment.

The sustainability of PEPE’s market position will likely depend on several factors, including the behavior of remaining major holders.

The entry of new investors at current price levels, and overall market confidence in the meme coin sector.

Traders and investors should note that while profitable opportunities exist, as demonstrated by several successful large-scale trades, the market remains highly volatile and requires careful position management.

Also Read: PEPE’s Price Soars as Elon Musk’s X Profile Picture Change Sparks Market Confusion