A seasoned crypto investor, tracked by Onchain Lens, has generated $3.05 million in profits from a strategic Ethena (ENA) token trade.

Over a span of seven months, the investor accumulated 12.06 million ENA tokens at a cost of $7.83 million.

After holding the tokens for three months of relative market inactivity, the whale recently withdrew 3.93 million ENA from the Coinone exchange, realizing a profit of $3.55 million from this portion of their holdings.

Ethena Token’s Mixed Performance Supports Profitable Trades

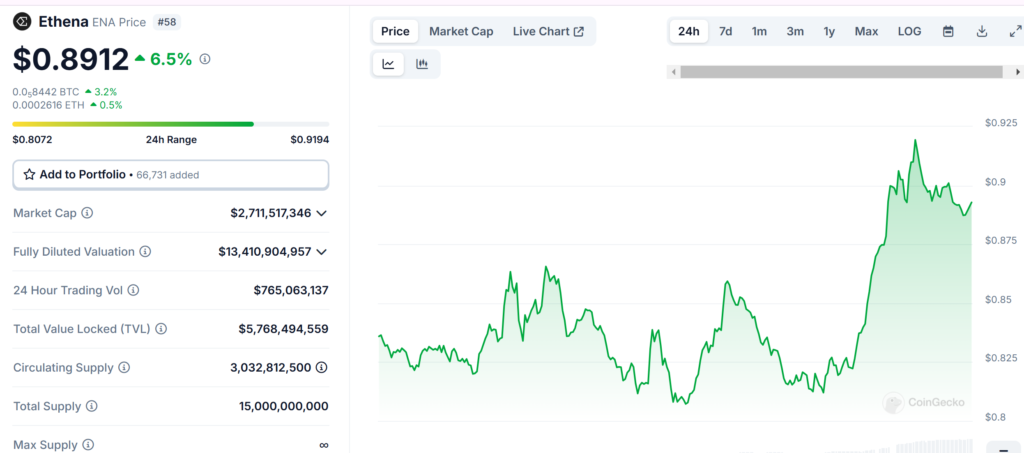

Ethena (ENA) has seen volatile price movements, offering both risks and opportunities for savvy investors. Over the past 24 hours, the token’s price rose by 6.52%, countering a 7-day decline of 5.85%.

The current ENA price of $0.891, paired with a trading volume of $765 million in the last day, reflects the token’s popularity and liquidity in the market.

With a market capitalization of $2.71 billion and a circulating supply of 3 billion tokens, Ethena continues to attract significant investor interest.

The whale’s holdings, currently valued at $10.88 million, highlight their ability to capitalize on these price fluctuations and secure long-term profitability.

Broader Market Trends in Crypto Profits

The Ethena whale’s success aligns with a larger trend of strategic crypto trading that has produced notable profits in recent months.

For example, a $2,500 investment in $ALON tokens yielded a $3.4 million profit after a 10-month holding period, showcasing the potential of patience in the volatile crypto space.

Similarly, a $69,700 investment in $VINE tokens turned into $2.29 million, reflecting the substantial gains possible through targeted memecoin trading.

These developments demonstrate the ongoing appeal of the cryptocurrency market as a space where sharp analysis and timing can yield significant returns.

Concerns Over Market Liquidity Amid Large Holdings

While large profits such as those from the Ethena trade reflect the crypto market’s potential, they also raise questions about liquidity and sustainability.

For instance, the Trump team’s holdings in TRUMP, MELANIA, and related meme tokens are estimated to be worth $2.3 trillion on paper but are subject to vesting schedules that prevent immediate liquidation.

Such situations highlight the challenges associated with large token positions in less liquid markets.

The Ethena whale’s strategy of staggered withdrawals illustrates a measured approach to managing these challenges, ensuring profitability while minimizing market disruption.

These dynamics underscore the importance of strategic planning for success in the cryptocurrency sector.

Also Read: Crypto Trader Turns $680K Into $43.5M Profit on $MELANIA Memecoin