Justin Sun, a prominent cryptocurrency entrepreneur, has unveiled an ambitious plan for the Ethereum Foundation (EF), projecting a potential ETH price target of $10,000 under his proposed leadership.

The comprehensive strategy, announced via the X platform, outlines a transformative approach to the foundation’s operations and Ethereum’s economic model.

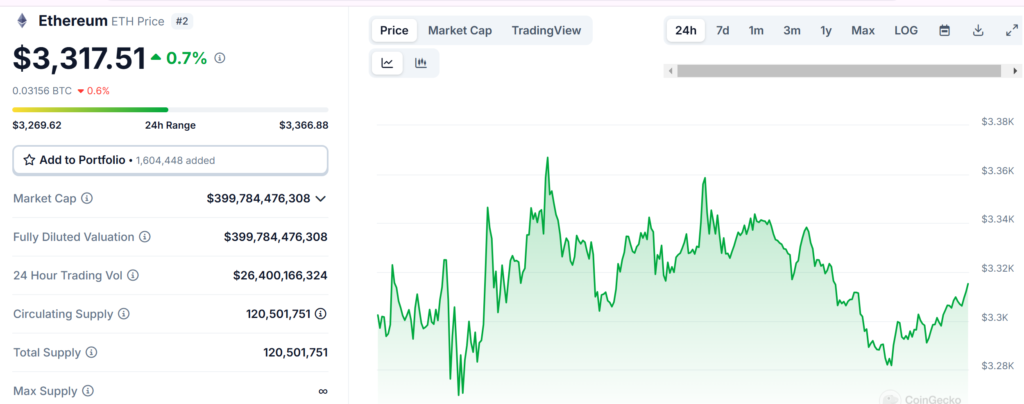

Currently, with Ethereum trading at $3,316.42 and maintaining a substantial market capitalization of $399.78 billion, Sun’s proposal arrives at a crucial time for the cryptocurrency.

His vision encompasses fundamental changes to the foundation’s structure and operations, aimed at strengthening Ethereum’s position as the leading blockchain platform.

Financial Strategy and Revenue Generation

The cornerstone of Sun’s financial strategy revolves around two primary initiatives: the immediate cessation of ETH sales by the Ethereum Foundation for a minimum three-year period, and the implementation of a new taxation system for Layer 2 projects.

Under this plan, the Foundation would sustain its operations through alternative funding sources, including AAVE lending, staking rewards, and stablecoin borrowing.

The proposed Layer 2 taxation system aims to generate approximately $5 billion in annual revenue, with these funds being directed toward ETH buybacks and burning mechanisms.

The approach is designed to enhance Ethereum’s deflationary characteristics while preserving and potentially increasing its value proposition.

Operational Restructuring and Efficiency Measures

Sun’s proposal includes a significant restructuring of the Ethereum Foundation’s operational framework.

The plan calls for a substantial reduction in staff numbers, retaining only the highest-performing team members who would receive enhanced compensation packages.

The merit-based system is designed to optimize operational efficiency while maintaining high standards of innovation and development.

Additionally, the proposal includes modifications to node rewards and an enhanced focus on fee-burning mechanisms, aiming to strengthen Ethereum’s deflationary nature and attract both institutional and retail investors.

Development Focus and Market Impact

The proposal emphasizes an exclusive focus on Layer 1 development, prioritizing scalability, security, and mainstream adoption.

Sun predicts that implementing these measures could drive ETH prices to $4,500 within the first week, ultimately targeting the $10,000 milestone.

The projection is supported by current market metrics, including a 24-hour trading volume of $26.4 billion and recent positive price movements, with ETH showing a 0.62% increase in the last 24 hours and a 3.36% gain over the past week.

Sun’s track record of successful ventures, including recent developments with TRON DAO’s $75 million WLFI investment and his involvement in various successful cryptocurrency projects, lends credibility to his ambitious vision for Ethereum’s future.

Also Read: Justin Sun Declares Tron ($TRX) As Antarctic Legal Tender, Raises Eyebrows