Hong Kong courts will now use tokenized digital notices for crypto wallets that have stolen funds or are linked to criminal offenses.

The move comes at a time when Hong Hong is using crypto currencies to become a hub of digital technology in Asia. The is likely to set the city apart from global peers, making it excel in the sector.

Hong Kong Sends Two Tron-Based Wallet

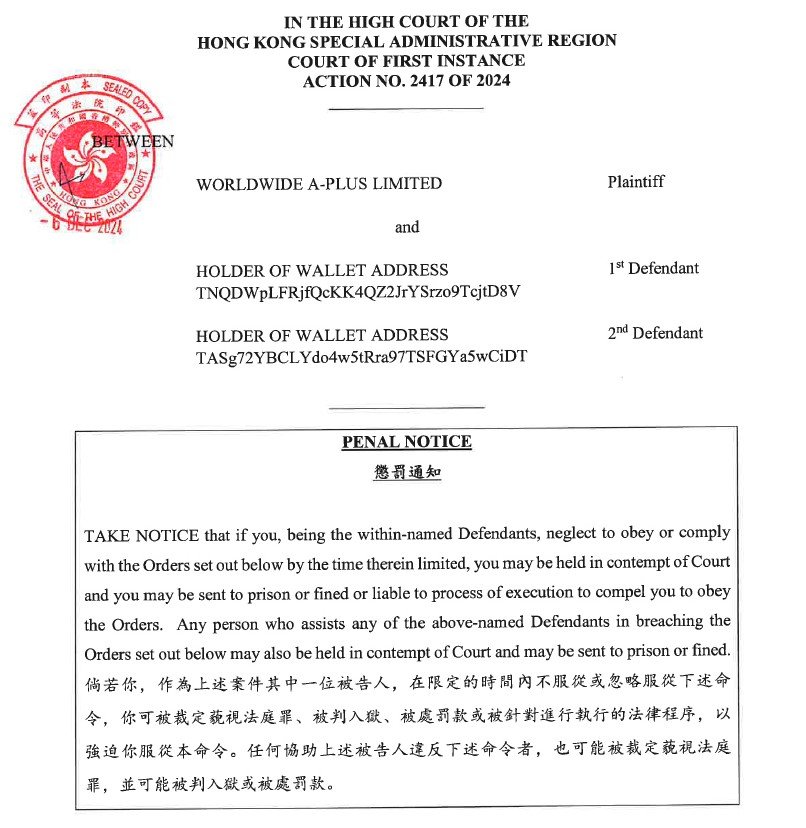

Implementing this rule, tokenized legal notices asking for the freezing of two Tron-based wallet addresses’ assets were sent by Hong Kong court. The court also stated that if transactions from these wallets keep taking place, they will be constituted as illegal transactions.

Although earlier decisions in the US and the UK have demonstrated how courts can adjust to new approaches, Hong Kong’s most recent tokenized notices set it apart by forbidding ignorance as a defense.

Hong Kong Takes Steps To Become Digital Hub in Asia

Hong Kong’s today’s move come as the city has decided to adopt crypto based assets heavily.

Previously, legislators in Hong Kong had suggested making Bitcoin a budgetary reserve. The formal announcement states that they have proposed incorporating Bitcoin into the city’s budgetary reserves and investigating the possibility of purchasing and holding it for a long time using the Exchange Fund.

The action was taken in light of Hong Kong’s goal to establish itself as Asia’s crypto powerhouse. The action is in line with other steps Hong Kong has taken to maintain Bitcoin as a key component of its financial strategy.

The move is intended to attract talent and finance, boost transaction stamp tax income, and promote the expansion of Hong Kong’s bitcoin sector.

Hong Kong Embarks On Stablecoin Bill

The proposed regulatory regime also took a step closer to becoming legislation when the Hong Kong government published a stablecoin bill in the gazette.

This action is a part of an attempt to reconcile financial stability and consumer protection while advancing its agenda on virtual assets.

As cryptocurrency popularity has increased globally, Hong Kong has likewise changed how it views digital assets. Hong Kong has rapidly become a global center for the issuance and trading of digital assets, attracting investors with its growing liquidity and the incentives and controls provided by an active regulator.

The industry’s innovation has resulted in the issuance of the first-ever blockchain-based, multi-currency green bond and the development of cryptocurrency spot and futures exchange-traded funds (ETFs).

The market is now anticipating the delivery of additional digital products following the establishment of a stablecoin sandbox earlier this year.