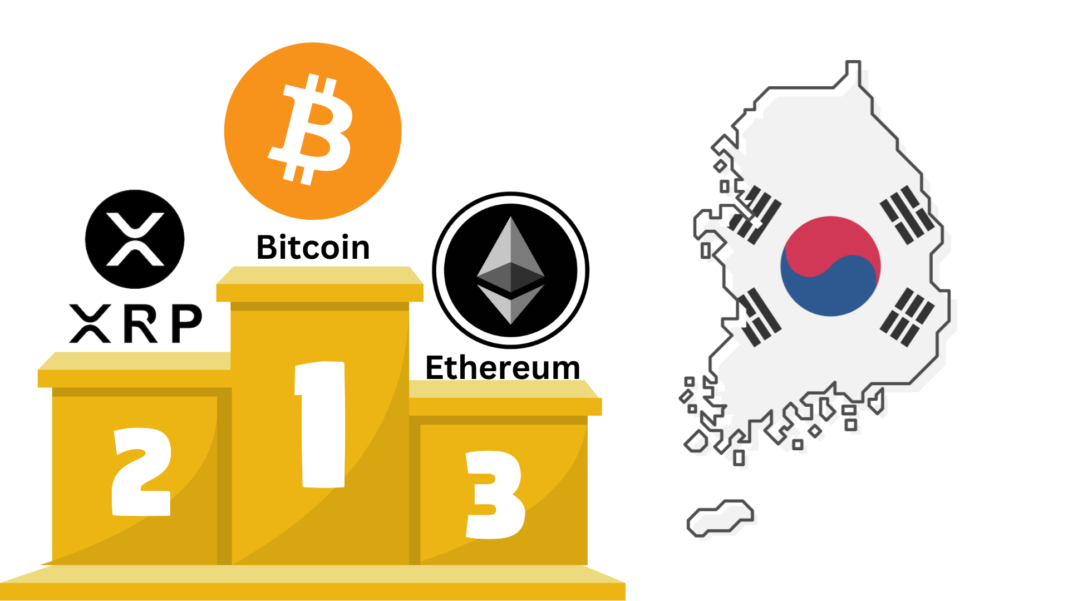

South Korea’s crypto market has seen a shift in investor preference regarding tokens. According to a recent survey, Ripple has overtaken Ethereum as the most popular cryptocurrency among South Korean investors, but Bitcoin is still their top choice.

According to a survey by Korean news station News1, XRP has overtaken Ethereum as the most popular cryptocurrency among South Korean investors amid a rise in the token’s popularity and demand.

The shift also mimics an overall sentiment in the global crypto market, where XRP has seen a skyrocketing popularity mainly due to its win the Ripple VS SEC case, Donald Trump’s pro crypto stance and other parameters.

South Korea’s Shift Towards XRP

The report highlights that over 5,220 investors were questioned about their top cryptocurrency picks between December 24 and December 26, 2024.

The top ten cryptocurrencies in South Korea by market capitalization were included in the poll. According to the results, Ethereum ranked third, XRP second, and Bitcoin first.

Also Read: Veteran Trader Peter Brandt Predicts Ripple’s ($XRP) $500B Potential Market Cap

Why is XRP Gaining Popularity Among Investors?

XRP’s image had been tainted for a long time due to the Ripple VS SEC case. However, the court case, which largely ended in favor of Ripple, saw investor confidence for XRP rising.

Additionally, the resignation announcement of SEC chair Gary Gensler after the victory of Donald Trump in the 2024 US elections further cemented the idea that XRP’s price trajectory was likely to surge in future.

Other parameters that have helped the token include, a favorable market climate, increasing institutional interest, and other legal victories. As XRP hits milestones not seen in years, the increase demonstrates its expanding prominence in the cryptocurrency industry.

Ripple has made a concerted effort to establish XRP as a financial institution tool. Cross-border payments are being made more quickly and affordably with the XRP Ledger (XRPL). Banks and payment providers have begun to implement this more frequently as a result.

Ethereum’s Dwindling Market Dominance: What is Happening?

Ethereum, despite its greater versatility, faces regulatory scrutiny and scalability issues, especially with relation to its shift to a proof-of-stake paradigm.

The gap also exists in institutional support. Wall Street has already given Bitcoin ETFs a reputation. A number of issues, such as institutional investors’ lack of interest, retail investors’ steadily declining interest, and the focus and capital shifting to Layer 2 and Layer 3 scaling efforts, are probably contributing to Ethereum’s decrease relative to Bitcoin.

Although Bitcoin Spot ETF continues to outperform, Ethereum Spot ETF’s performance demonstrates why the altcoin has not been able to attract institutional investment.

Read Also: Ethereum Co-Founder Vitalik Sells 340B DOG Coins for 5.204 ETH Making Another Sell Off For Charity