A significant development in the cryptocurrency market has emerged as a newly created wallet holder faces substantial losses after a major FARTCOIN investment.

The investor earlier today deployed 1.02 million USDC to acquire 1,055,183 FARTCOIN tokens at an average price of $0.97 per token.

According to Onchain Lens monitoring, this substantial investment has resulted in an approximate loss of $87,000 due to subsequent price movements.

The situation highlights the volatile nature of emerging cryptocurrency investments and the potential risks involved in large-scale token acquisitions.

Current Market Status

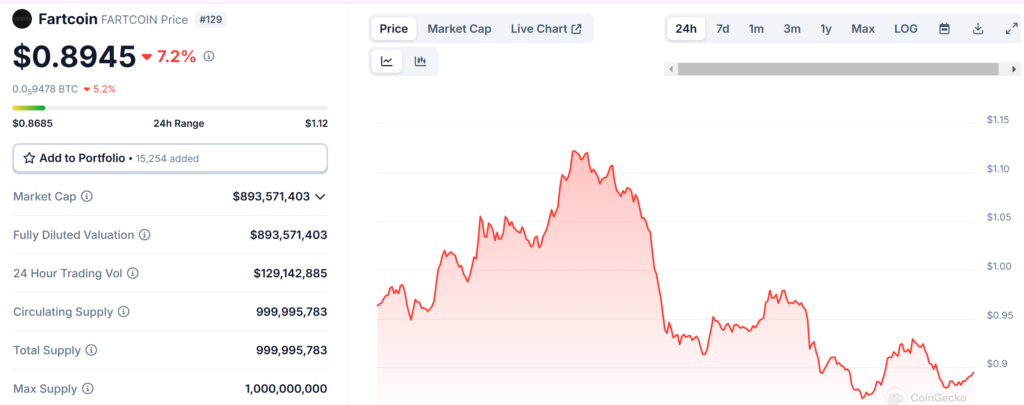

FARTCOIN’s current market performance shows significant volatility, with the token trading at $0.8947.

The cryptocurrency has experienced notable price declines, showing a 7.18% decrease in the last 24 hours and a 5.69% decline over the past week.

The token maintains a substantial trading volume of $129,142,885 within the last 24 hours, indicating active market participation.

With a circulating supply of 1 billion FARTCOIN, the project currently holds a market capitalization of $893,571,403, positioning it as a significant player in the alternative cryptocurrency market despite recent price fluctuations.

Contrasting Investment Outcomes

The recent loss stands in stark contrast to other FARTCOIN investment stories that have emerged in the market.

A notable example includes a whale investor who achieved $2.53 million in unrealized profits following the CHILLGUY selloff, during which FARTCOIN experienced a remarkable 33% price increase in 24 hours and a 170% surge over a week, pushing its market capitalization to $657 million.

Additionally, another successful case involved a FARTCOIN investor who transformed an initial investment of $122,000 into $13.36 million, achieving a remarkable 1,090x return while maintaining a position of 12.54 million tokens valued at $12.16 million.

Market Implications and Investment Patterns

These contrasting investment outcomes in FARTCOIN demonstrate the highly speculative nature of emerging cryptocurrency markets.

The varied results, from significant losses to substantial gains, highlight the importance of timing and strategy in cryptocurrency investments.

The market has shown particular interest in the case of the investor who subsequently diversified their profitable FARTCOIN position by investing $691,000 in 10.3 million $MIRA tokens.

These developments continue to shape market sentiment and trading patterns within the FARTCOIN ecosystem, influencing both new and existing investors’ approaches to risk management and investment timing.