The cryptocurrency market is bracing for a significant event as approximately 176 million TIA tokens (Celestia) are scheduled for unlocking, representing 79.52% of the current circulation and valued at approximately $900 million.

According to Taran, founder of the OTC platform STIX, detailed analysis suggests that 92.3 million TIAs are expected to enter actual circulation post-unlock.

This figure includes unstaked tokens, tokens in the 21-day unstaking queue, and approximately 24.1 million unrecorded tokens.

The potential maximum selling pressure is estimated at $460 million, which notably represents less than 50% of the total cliff unlocks, indicating that the actual sell pressure might be significantly lower than market expectations.

This translates to a 41.8% dilution ratio when comparing the real increase in circulating supply against the current circulating supply.

Technical Analysis and Market Mechanics

On-chain data analysis through the Celenium.io API has revealed intricate details about the unlock dynamics and their potential impact on TIA’s price action.

The 21-day unstaking period has played a crucial role, as participants wanting to trade their TIA by October 31 had to initiate the unstaking process in advance.

A significant observation is that substantial portions of the first unlock were sold to OTC buyers, who subsequently hedged their positions using perpetual futures, leading to a dramatic increase in open interest over recent months.

Market analysts anticipate these shorts will continue to unwind, potentially offsetting some of the spot-selling pressure and potentially creating a positive signal for spot buyers as funding rates reset.

Also Read: Altcoins To Face Serious Selling Pressure As $500M Token Unlocks This Week

Historical OTC Trading Patterns

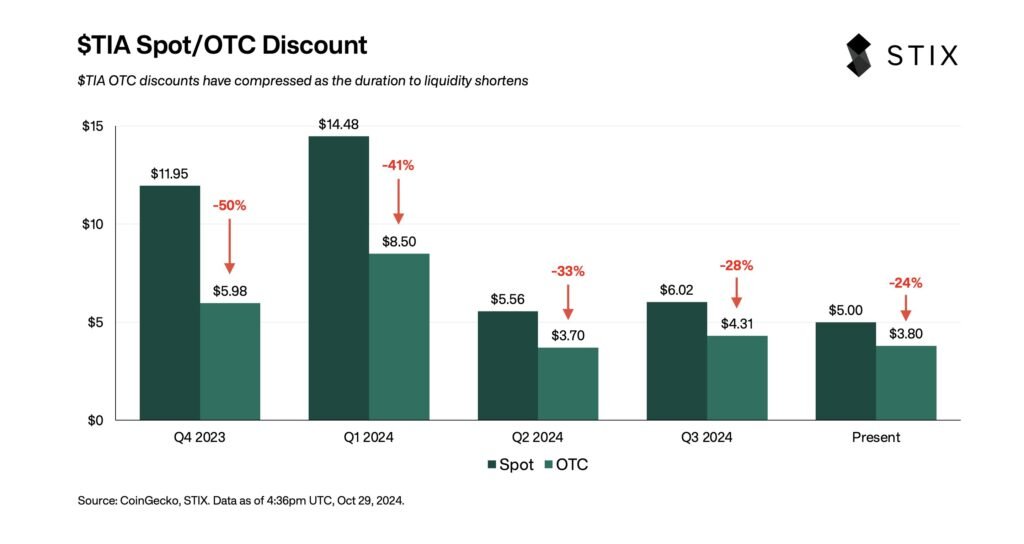

Celestia has emerged as one of the most actively OTC-traded assets in the current market cycle. The trading patterns have shown interesting variations across different periods.

In Q1 2024, when TIA rallied above $20, OTC activity was minimal due to sellers’ reluctance to accept large discounts (40+%) and buyers’ resistance to bid above the $8.5 ceiling.

The dynamics shifted significantly when TIA’s price fell below $5, coinciding with the Celestia Foundation’s $100 million OTC round at $3.

STIX’s platform alone has facilitated approximately $60 million in TIA trading volume since July 2024, suggesting a total market OTC trading volume exceeding $80 million across various liquidity channels, assuming STIX maintains a 75% market share in OTC trading.

Market Outlook and Trading Implications

The upcoming token unlock represents one of the most widely anticipated events in the current market cycle.

Several key factors are expected to influence market dynamics: continued unwinding of short positions, potential reset of funding rates to neutral or positive territory, and additional spot supply from October unstaking activities.

The magnitude of the supply shock, combined with its high visibility and suppressed OTC discounts, is expected to generate significant market activity.

The analysis included certain assumptions, notably regarding OTC round buyers’ 11 million TIA cliff unlock and the mapping of 292 vesting wallets, with some gaps included in the non-staked category.

This comprehensive understanding of the unlock mechanics and market dynamics provides valuable insights for market participants navigating this significant event in the Celestia ecosystem.

Also Read: WLD and SOL Top the Linear Unlocking List Amid Over 2% Price Surge